All Categories

Featured

Table of Contents

On the other hand, if a client needs to offer an unique needs child that may not be able to manage their own cash, a depend on can be included as a beneficiary, permitting the trustee to take care of the circulations. The kind of beneficiary an annuity owner chooses impacts what the recipient can do with their acquired annuity and how the profits will certainly be strained.

Numerous agreements allow a partner to identify what to do with the annuity after the proprietor dies. A partner can transform the annuity contract right into their name, thinking all guidelines and civil liberties to the initial agreement and postponing instant tax obligation consequences (Tax-efficient annuities). They can collect all continuing to be payments and any type of survivor benefit and pick recipients

When a spouse comes to be the annuitant, the spouse takes over the stream of repayments. This is referred to as a spousal continuation. This clause permits the surviving spouse to preserve a tax-deferred condition and safe and secure long-lasting economic security. Joint and survivor annuities also enable a called beneficiary to take over the agreement in a stream of payments, as opposed to a swelling amount.

A non-spouse can just access the marked funds from the annuity proprietor's initial contract. Annuity proprietors can choose to mark a trust fund as their recipient.

Annuities For Retirement Planning

These differences designate which recipient will receive the entire fatality advantage. If the annuity proprietor or annuitant dies and the main beneficiary is still to life, the main recipient gets the survivor benefit. If the main recipient predeceases the annuity proprietor or annuitant, the fatality benefit will go to the contingent annuitant when the owner or annuitant passes away.

The owner can transform beneficiaries any time, as long as the contract does not call for an irreversible beneficiary to be named. According to expert contributor, Aamir M. Chalisa, "it's vital to comprehend the importance of assigning a beneficiary, as choosing the wrong recipient can have severe repercussions. Most of our customers choose to name their underage youngsters as beneficiaries, often as the key beneficiaries in the absence of a spouse.

Proprietors who are married must not assume their annuity instantly passes to their partner. When picking a beneficiary, think about elements such as your connection with the person, their age and how acquiring your annuity might influence their economic circumstance.

The recipient's partnership to the annuitant generally determines the rules they adhere to. For example, a spousal beneficiary has more choices for dealing with an inherited annuity and is treated even more leniently with tax than a non-spouse beneficiary, such as a youngster or other relative. Senior annuities. Suppose the proprietor does decide to name a child or grandchild as a beneficiary to their annuity

How do I choose the right Fixed-term Annuities for my needs?

In estate preparation, a per stirpes designation specifies that, must your recipient pass away before you do, the beneficiary's descendants (youngsters, grandchildren, et cetera) will certainly obtain the survivor benefit. Connect with an annuity expert. After you've chosen and named your beneficiary or recipients, you have to remain to examine your options at the very least when a year.

Maintaining your designations as much as date can make sure that your annuity will certainly be managed according to your dreams must you pass away suddenly. Besides an annual testimonial, major life occasions can prompt annuity proprietors to reconsider at their beneficiary selections. "Somebody could wish to upgrade the recipient classification on their annuity if their life scenarios alter, such as marrying or divorced, having children, or experiencing a fatality in the household," Mark Stewart, CPA at Action By Step Service, told To change your recipient designation, you must get to out to the broker or agent that handles your contract or the annuity supplier itself.

How do I choose the right Annuity Payout Options for my needs?

Similar to any type of financial item, seeking the help of a monetary consultant can be beneficial. A monetary coordinator can guide you through annuity administration processes, including the methods for upgrading your contract's beneficiary. If no recipient is named, the payout of an annuity's survivor benefit goes to the estate of the annuity owner.

To make Wealthtender totally free for readers, we make money from marketers, consisting of monetary professionals and firms that pay to be included. This creates a problem of rate of interest when we prefer their promo over others. Read our editorial plan and terms of solution to get more information. Wealthtender is not a client of these monetary solutions companies.

As a writer, it is among the most effective praises you can provide me. And though I really value any of you investing a few of your hectic days reading what I create, slapping for my article, and/or leaving appreciation in a remark, asking me to cover a subject for you absolutely makes my day.

It's you saying you trust me to cover a topic that is essential for you, and that you're positive I would certainly do so much better than what you can currently discover on the internet. Pretty spirituous stuff, and a duty I do not take likely. If I'm not acquainted with the subject, I research it on the internet and/or with contacts who recognize even more about it than I do.

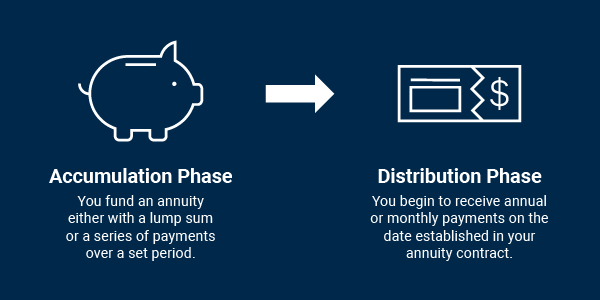

What are the tax implications of an Annuity Accumulation Phase?

In my pal's situation, she was believing it would certainly be an insurance plan of sorts if she ever before enters into taking care of home care. Can you cover annuities in a post?" Are annuities a valid recommendation, an intelligent action to secure guaranteed earnings for life? Or are they a dishonest consultant's method of fleecing innocent customers by convincing them to relocate properties from their profile into a difficult insurance policy item plagued by excessive charges? In the simplest terms, an annuity is an insurance item (that just qualified representatives may offer) that ensures you monthly repayments.

This usually applies to variable annuities. The even more riders you tack on, and the less risk you're prepared to take, the lower the repayments you need to anticipate to obtain for a provided costs.

How do I choose the right Lifetime Payout Annuities for my needs?

Annuities picked correctly are the best choice for some individuals in some situations., and after that figure out if any annuity choice offers sufficient advantages to warrant the prices. I utilized the calculator on 5/26/2022 to see what a prompt annuity may payment for a solitary costs of $100,000 when the insured and partner are both 60 and live in Maryland.

Table of Contents

Latest Posts

Understanding Fixed Vs Variable Annuity Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Features of Indexed Annuity Vs Fixed Annuity Why Fixed Index Annuit

Breaking Down Fixed Income Annuity Vs Variable Growth Annuity A Comprehensive Guide to Fixed Interest Annuity Vs Variable Investment Annuity Defining Fixed Index Annuity Vs Variable Annuity Benefits o

Breaking Down Your Investment Choices Key Insights on Your Financial Future Breaking Down the Basics of Fixed Interest Annuity Vs Variable Investment Annuity Advantages and Disadvantages of Different

More

Latest Posts